georgia film tax credit history

A Georgia taxpayer may purchase Georgia Entertainment Credits generally for around 88 per credit and apply them to their current year or future tax. CERTIFICATION PROCESS FOR THE 20 PERCENT GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 transferable tax credit the Georgia Department of Economic Development must certify the project.

Rashomon Poster Directed By Akira Kurosawa Film Posters Vintage Movie Posters Cinema Posters

The 500 of withholding would be eligible for a refund.

. Under the act the Georgia movie tax credit is available to both Georgia residents and non-residents. Withheld shall be deemed to have been withheld by the loan-out company on wages paid to its employees. How-To Directions for Film Tax Credit Withholding.

Certification for live action projects will be through the Georgia Film Office. Certification must be applied for within 90 days of. Many are unaware of this but Georgia is known as the Hollywood of the South because of all the film productions which choose the state as the location of choice.

Minnesota Hawaii and Missouri were the second third and fourth states to pass a tax credit program for the film industry in the late 90s. How to File a Withholding Film Tax Return. A Base Certification Application may be submitted within 90 days of the start of principal photography.

Third Party Bulk Filers add Access to a Withholding Film Tax Account. Projects first certified by DECD on or after 1121 with. The audit is requested through the Georgia Department of Revenue website GDOR and.

EUE Screen Gems offers a 6 decade history of making film television and also commercial projects of the best quality. 20 base transferable tax credit. So for example if you had a Georgia income tax liability of 50000 you could purchase enough credits at 89 of there value that would equal 44500.

On average 1 of Georgia Film Tax credit can be purchased for 087 to 090. Production companies are required to withhold 6 Georgia income tax on all payments to loan-out. The industry in Georgia was boosted substantially by tax incentives.

GA Film Tax Credit - List of Expenditures final 12-14-18pdf 3015 KB. This is an easy way to reduce your Georgia tax liability. The broadening of this legislation permits a Georgia corporate fiduciary or individual taxpayer to purchase these credits to offset their Georgia income tax liability.

Beginning January 1 2021 mandatory film tax credit audits must be conducted before usage of the film tax credit. Certification for live action projects will be through the Georgia Film Office. All productions with credit more than 125000000.

Film Tax Credit Electronic IT-TRANS Submission Outside of a GTC Login. For example you could purchase 20000 of 2017 Georgia Entertainment Credits for 17400 resulting in an immediate savings of 2600. For example an individual purchases 1000 of Georgia film credits and had a 600 Georgia income tax liability for the year and had 500 Georgia withholding from their wages.

The mandatory film tax credit audit is based on the date the production was first certified by the Department of Economic Development DECD and the credit amount according to the following schedule. Taxpayers have the ability to purchase these credits retroactively for up to three years. Although Georgia provides an incredible Georgia film tax credit the pairing of both the state of Georgia and EUE Screen Gems makes for top quality productions with a low bearing cost making the 2 a great deal found.

At one time 44 states offered a film tax incentive. All productions with credit more than 250000000. CBS46 - A big development today in the effort to limit Georgias tax credit for the film industry.

September 8 2020. Instructions for Production Companies. Most of the credits are purchase for 87-92 of their face value.

About the Film Tax Credit First passed in 2005 Georgias film tax credit provides an income tax credit to production companies that spend at least 500000 on qualified productions. April 09 2014. An audit is required prior to utilization or transfer of any earned Georgia film tax credit that exceeds 25 million in 2021 125 million in 2022 and for any credit amount thereafter.

Companies for services performed in Georgia when getting the Georgia Film Tax Credit. Of the film tax credit 18-03A was released earlier this month. Georgia is a production-friendly state with transferable film tax credits up to 30 of qualified expenditures.

This surge of activity is largely due to the tax incentives that have been offered to major production companies since 2008. Audits are required for Film Tax Credits based on the date the production was certified by the Department of Economic Development DECD and the amount of credit. The income bill passed.

GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project. DOR and have a Georgia Tax Center GTC logon Within 90 days of the completion of the base investment or excess base investment in this state. This 50000 would apply to current year or prior year taxes owed and any remaining amount.

The credit would offset the Georgia liability of 600 while 400 of the credit would carry forward to the subsequent tax year. On August 4 2020 Governor Kemp signed into law HB. The new law appears to be in response to an audit report issued by the Department of Audits and Accounts DOAA earlier this year that called into question the.

An additional 10 credit can be obtained if the finished project. The film industry in Georgia is the largest among the states of the United States for production of feature films by number of films produced as of 2016. In the past few years Georgia has become a hub for film and television businesses spanning commercials to feature films to television series.

Atlanta is the center of the film industry in Georgia with Turner Tyler Perry and EUEScreen Gems studios located there. For services performed in Georgia. 1037 which enacts significant procedural changes to the states film tax credit allowed pursuant to OCGA.

The base credit rate was raised to 20 in 2008 with an additional 10 for a qualified. This is perhaps the easiest way to reduce your Georgia tax liability. Register for a Withholding Film Tax Account.

There is a salary cap of 500000 per person per production when the employee is paid by salary which is defined by the Georgia film incentives website as being paid with a W2. Claim Withholding reported on the G2-FP and the G2-FL. In 2011 Louisiana hosted over 150 productions with an attributed 13 billion in film industry-related revenues to the state.

If the production company pays an individual for services as a loan-out a personal. In fact according to the Georgia Department of Economic Development there was a new record set last year with 399. Some of the major films and television shows to take advantage of the Georgia.

Tax The Georgia film credit can offset Georgia state income tax. Important Changes to the Georgia Film Tax Credit. The Georgia Department of Revenue GDOR offers a voluntary program.

Qualifying Projects 20 tax credit is provided for companies that spend 500K or more on production and post production in Georgia. Includes a promotional logo provided by the state.

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

The Bowery Went Down To Georgia Georgia Film Savannah Chat

Florida Minimum Wage Minimum Wage Previous Year How To Plan

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Design A Powerful Logo For A Modern Take On Industrial Construction And Finance Logo Design Contest Logo Design Construction Company Logo Logo Design Contest

Georgia Film Industry Posts Record Year After Blow Dealt By Covid

Truck Loaded With Coal Vector Free Illustrator Tutorials Illustrator Template

Pin By Yamila Malone On Credit Repair Credit Repair Letters Credit Repair Improve Credit

Film Industry In Georgia Georgian Film Cluster

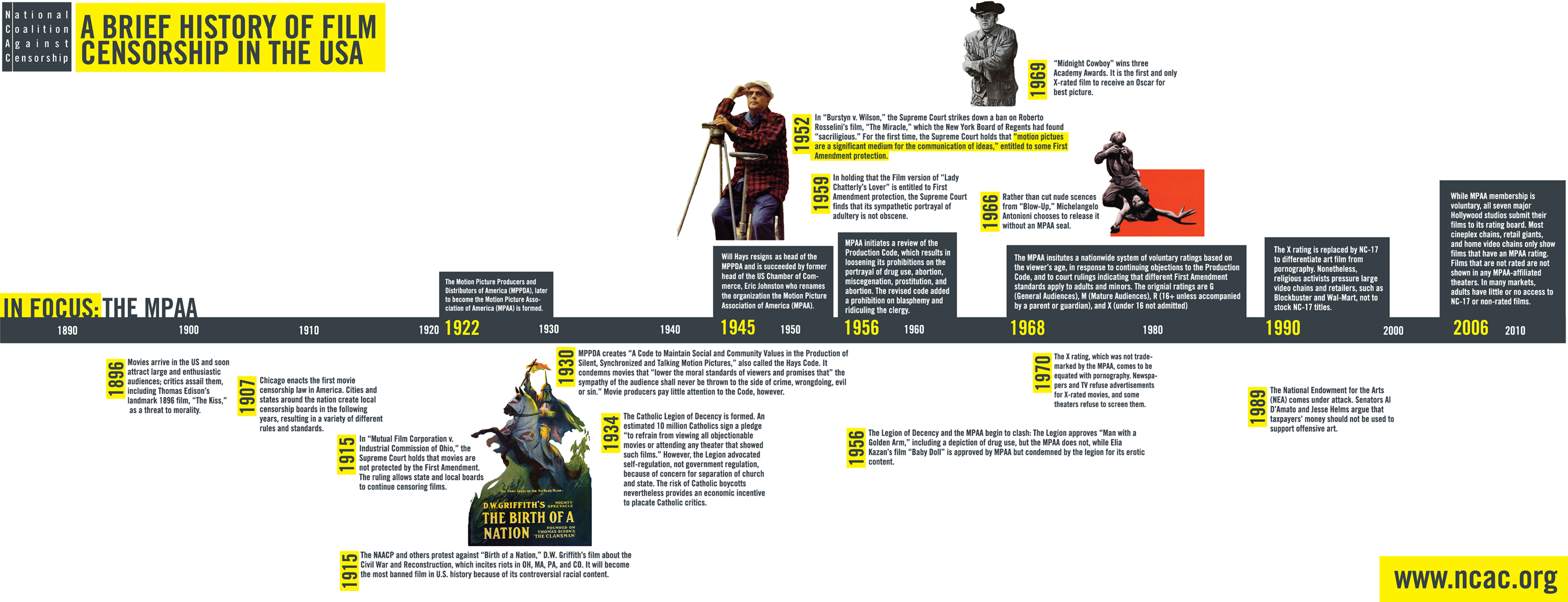

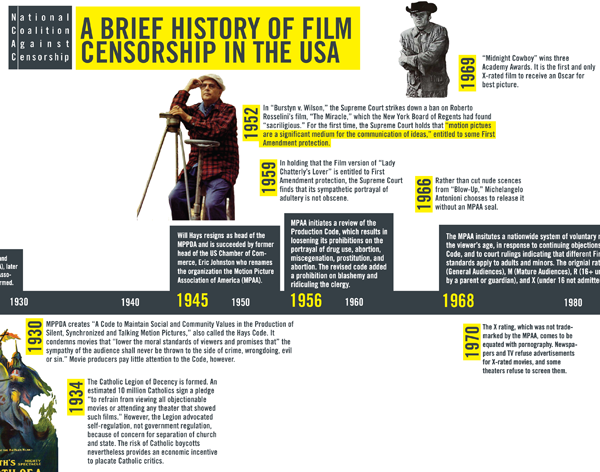

A Brief History Of Film Censorship National Coalition Against Censorship

10 Best States For Film Production Tax Breaks

Evolution Of Insurance Origin And History Of Insurance History Of Insurance Evolution History

Barzona Films Beautiful Logos Design Logo Design Personal Logo Design

Film Industry In Georgia New Georgia Encyclopedia

A Brief History Of Film Censorship National Coalition Against Censorship

Audits Becoming Mandatory For Georgia S Film Tax Credit Mauldin Jenkins

Georgia Film Records Blockbuster Year Georgia Department Of Economic Development